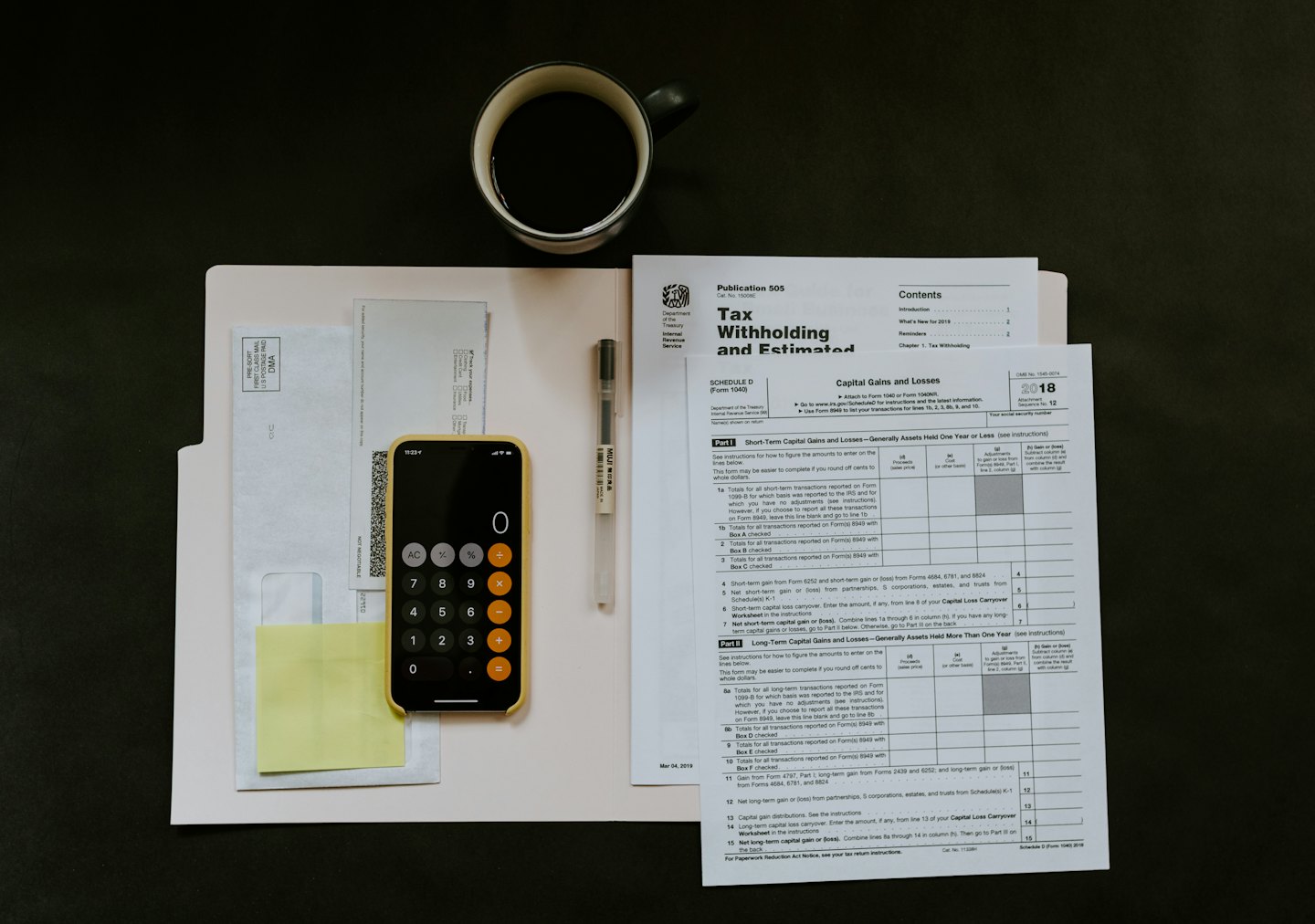

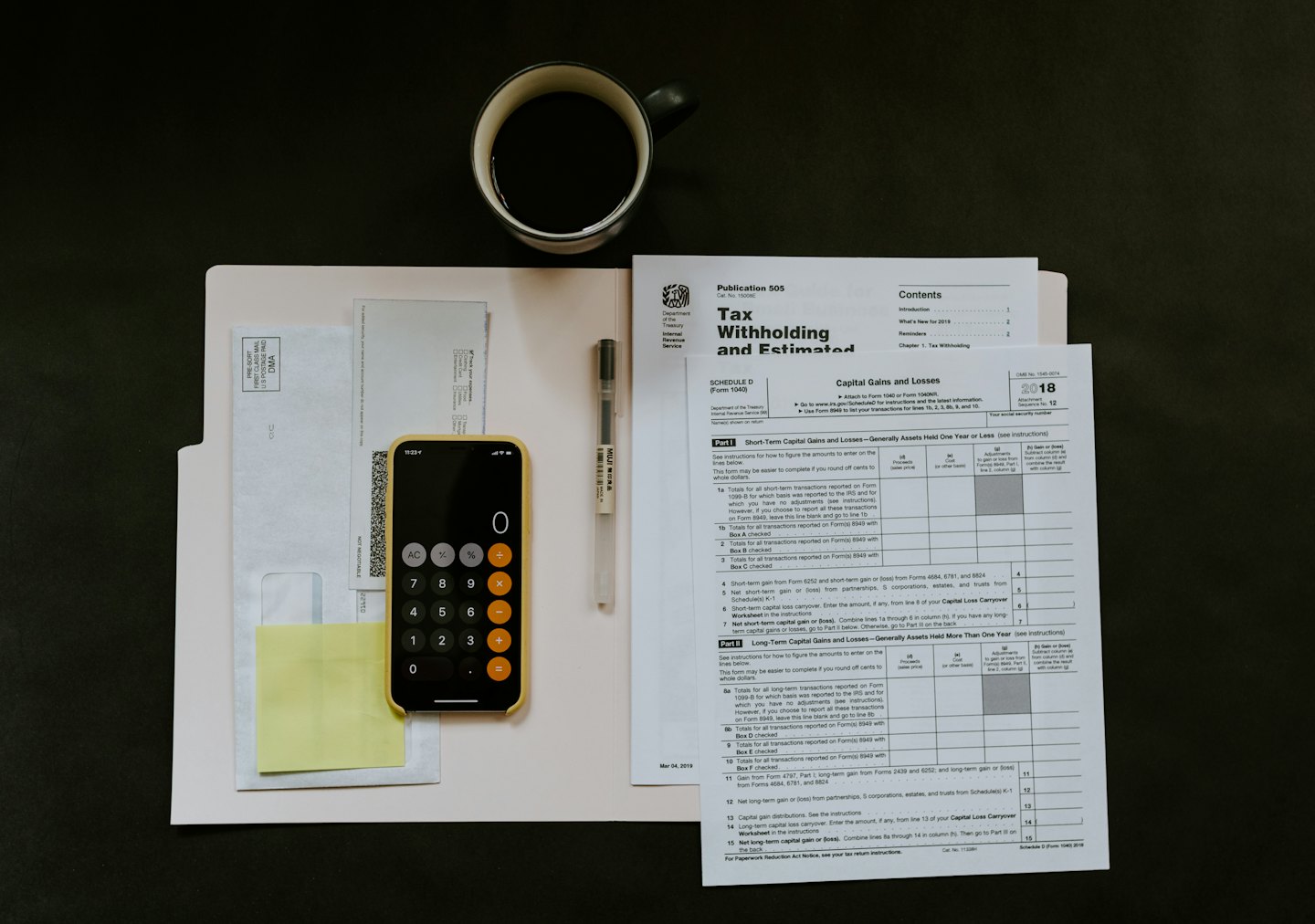

Comprehensive Payroll Services

Explore our comprehensive expert payroll solutions designed to guarantee absolutely precise calculations, ensure timely deposits every payroll cycle, and maintain full compliance with all relevant regulations and legal requirements. Learn more about federal payroll regulations from the U.S. Department of Labor and IRS payroll tax requirements.

Payroll Tax Management

Efficient and accurate handling of all payroll tax withholdings and filings to ensure your business remains fully compliant with all relevant regulations and requirements. This comprehensive service helps you avoid penalties and maintain smooth operations.

Direct Deposit Processing

We offer secure and prompt direct deposit services designed to efficiently handle payments for both employees and contractors alike, ensuring timely and reliable transactions every time. Our system guarantees the safety and accuracy of each deposit, providing peace of mind and convenience for all parties involved. For additional guidance, see the Federal Reserve’s direct deposit overview.

Recordkeeping and Compliance

Consistently maintaining well-organized and highly secure payroll records is essential, while also ensuring full compliance with all applicable regulatory standards and legal requirements. This involves implementing robust systems and procedures to safeguard sensitive employee information and accurately document payroll transactions at all times.

Discover Our Payroll Expertise

An in-depth overview of our comprehensive Payroll Services designed to meet all your business needs efficiently and accurately. Our payroll services cover every aspect of the payroll process, ensuring seamless management and compliance with all relevant regulations.

Accurate Paycheck Processing

Make sure that every single paycheck is carefully calculated with the utmost precision and accuracy, and consistently delivered promptly and on time without any delays.

Timely Tax Filing

We take full responsibility for managing all payroll tax withholdings and ensuring timely submissions, so you remain fully compliant with all relevant regulations and avoid any potential penalties or issues.

Secure Recordkeeping

Maintain well-organized and securely protected payroll records to ensure they are easily accessible and ready for thorough audits whenever needed. This practice helps streamline payroll management and supports compliance with regulatory requirements.

Direct Deposit Services

Facilitate efficient and timely processing of direct deposits to ensure that employees and contractors receive their payments promptly and without any delays. This service guarantees smooth and reliable transfer of funds directly into their bank accounts, improving overall satisfaction and financial management.

Compliance Assurance

Stay consistently informed and up-to-date with all the latest payroll regulations and compliance requirements to ensure your business avoids any potential penalties or fines. Keeping current with these rules is essential for smooth payroll management and safeguarding your company from costly mistakes.

Streamlining Payroll Processes for Your Business Success

Explore some of the most common and frequently encountered payroll challenges that businesses face, and discover how our expert services provide precise, fully compliant, and timely payroll solutions specifically tailored to meet your unique needs and requirements.

Accurate Paycheck Calculations

We make sure that every single paycheck is calculated with the utmost precision and care, accurately reflecting all applicable deductions and benefits to ensure your employees remain fully satisfied and confident in their compensation.

Timely Direct Deposits

Our system is designed to guarantee on-time direct deposits every single pay period, effectively eliminating any potential payment delays that could disrupt financial planning. This reliability not only ensures employees receive their wages promptly but also significantly enhances their trust in the organization and boosts overall morale within the workplace.

Compliance and Recordkeeping

We handle all aspects of tax withholdings and filings meticulously, while also maintaining secure and accurate records. This comprehensive approach guarantees that your payroll processes remain fully compliant with all relevant regulations and are consistently well-organized for your peace of mind.

Our Payroll Process

Discover how our comprehensive payroll services guarantee precise and timely paychecks, full tax compliance with all regulatory requirements, and dependable, organized recordkeeping to support the smooth operation and financial health of your business.

Step One: Setup & Onboarding

We collect detailed information about your business operations and employee details in order to configure payroll systems that are specifically tailored to meet your unique needs and requirements. This thorough process helps us establish a robust foundation for compliance, ensuring that all payroll activities adhere strictly to relevant laws and regulations.

Step Two: Payroll Management

Accurate paycheck calculations, precise tax withholdings, and timely direct deposits are all handled seamlessly and efficiently to ensure that your entire payroll process runs smoothly and without any disruptions.

Step Three: Reporting & Compliance

We take full responsibility for managing all your tax filings accurately and on time, maintain highly secure and organized records for your peace of mind, and provide comprehensive and detailed reports to guarantee that your business remains fully compliant with all regulations and consistently well-informed about your financial standing.

Samantha Lee

Human Resources Manager

Henriquez Accounting transformed our payroll process with unmatched accuracy and timely service, making our operations seamless.